Media Center

Latest News

WASHINGTON, DC – This evening, the House overwhelmingly approved the Middle Class Health Benefits Tax Repeal Act (H.R. 748), bipartisan legislation introduced by Rep. Courtney that would repeal the looming 40% excise tax on certain employer-sponsored health insurance plans known as the "Cadillac Tax." Rep.

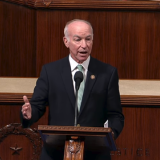

WASHINGTON, DC – Today, Congressman Joe Courtney (CT-02) took to the House Floor to highlight a new lawsuit aimed at the U.S. Department of Education's (ED) failure to properly administer the Public Service Loan Forgiveness (PSLF) Program. Courtney's remarks come following reports of a lawsuit recently filed against ED and Secretary Betsy DeVos by the American Federation of Teachers, which seeks to hold the Department accountable for its "gross mismanagement" of PSLF and Temporary Expanded Public Service Loan Forgiveness (TEPSLF).

The House plans to vote Wednesday on legislation that would roll back the so-called "Cadillac tax" under the 2010 health care law known as Obamacare.

The 40 percent surcharge tax applies to certain high-cost employer health care plans (hence the "Cadillac tax" nickname). It isn't set to take effect until 2022, and Congress has twice delayed its implementation.