In the News

On Sept. 1, interest began to accumulate for federal student loans again, marking an unwelcome milestone for family budgets.

Since March 2020, when the COVID CARES Act passed with overwhelming bipartisan support, student loan payments—both on the principal and on the interest—have been suspended for approximately 43 million student loan borrowers across the country. The CARES Act’s “payment pause” was extended numerous times by former president Trump and then President Biden over the ensuing three and a half years.

U.S. Rep. Joe Courtney, D-2nd District, U.S. Rep. Joyce Beatty, D-Ohio, and U.S. Sen. Richard Blumenthal, D-Conn., will introduce on Monday comprehensive federal legislation to address mold in federally subsidized housing in response to complaints about mold from Branford Manor residents.

VERNON — With more of their students facing psychiatric hospitalizations, public school teachers and administrators are keenly aware of the need for increased mental health support in the school system.

U.S. Rep. Joseph Courtney, D-2nd District, visited Vernon Center Middle School to offer some assistance. The Congressman was on hand Tuesday to tout the $323,000 in federal grants over the next three years to help hire more mental health specialists, such as social workers.

Tens of millions of Americans who have student loan debt are slated to resume making payments in the fall. The interest that comes with that debt will kick in again, too.

U.S. Rep. Joe Courtney, D-2nd District, toured two southeastern Connecticut shipyards Tuesday, touting the federal government’s investment in the region’s maritime economy and heritage.

Thames Shipyard & Repair Co. in New London and the Mystic Seaport Museum’s Henry B. duPont Preservation Shipyard will receive shares of that investment in the form of 2023 Small Shipyard Grants awarded by the U.S. Department of Transportation’s Maritime Administration.

Thames Shipyard will receive $309,853, while Mystic Seaport Museum has been awarded $214,452.

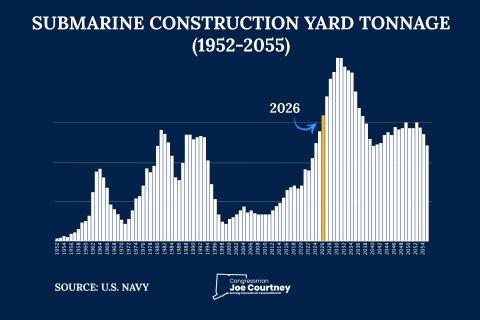

One of the strongest supporters of the AUKUS security pact in the US congress has urged “everyone to take a deep breath”, amid growing fears US shipyards won’t have the capacity to provide Australia with nuclear-powered submarines before the nation has the capacity to build them itself.

The news that two key US senators have warned President Joe Biden that the AUKUS agreement under which Australia will buy nuclear-powered submarines could threaten US security by stressing the nation’s submarine industrial base “to breaking point” is problematic for Australia.