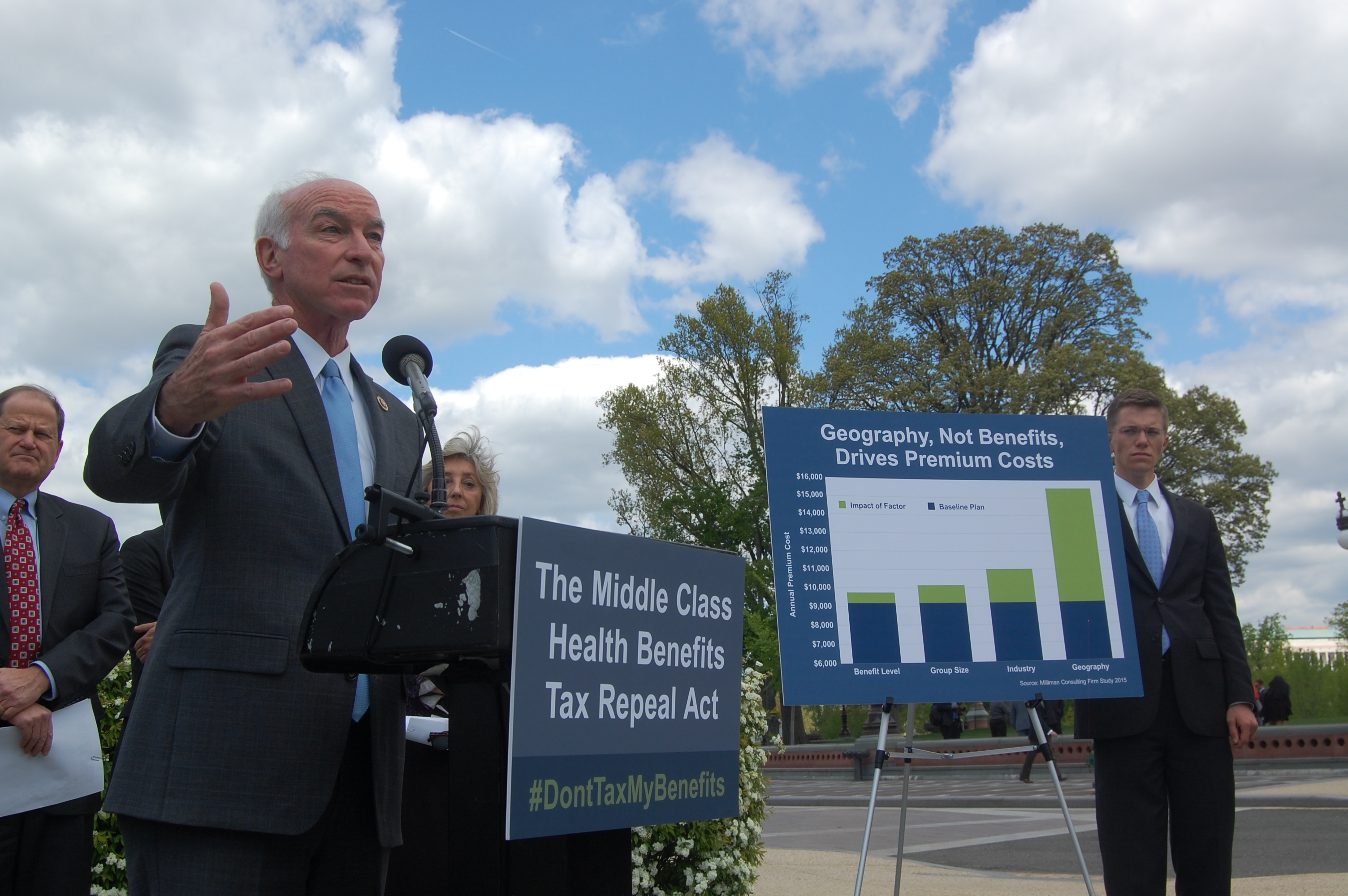

Repeal the Cadillac Tax

On January 24, 2019 Congressman Joe Courtney (CT-2) reintroduced the Middle Class Health Benefits Tax Repeal Act (H.R. 748), a bill to permanently repeal the excise tax on high-cost health insurance plans. Also known as the "Cadillac tax," the policy would apply a 40 percent tax on health insurance expenditures over $11,200 for an individual and $30,150 per family. Implementation of the excise tax is currently scheduled to take place in 2022, after being delayed twice.

In recent years, Americans who receive their health insurance from an employer have seen their deductibles and out of pocket costs rise dramatically. According to a recent Kaiser Family Foundation survey, deductibles on employer-sponsored plans have risen 212% in the past 10 years. Since 2005, we have seen the number of under-insured Americans more than double as health care becomes more unaffordable, even for those who do have insurance. Implementing the 40% excise tax will only exacerbate this crisis.

If the Cadillac Tax goes into effect, employers will reduce the value of their health benefits to avoid the tax threshold, or will make up the difference by shifting costs onto workers and their families. Taxing health benefits is the wrong way to reduce health costs. Additionally, economists and actuaries have projected that the tax will unfairly and disproportionately impact older workers, smaller businesses, women, and workers in regions with high health care costs. These are factors over which employers have no control. Instead of curbing costs, the tax will burden workers, and specifically those who already face high health care costs.

Congressman Courtney's legislation has the overwhelming bipartisan support of over 80% of the House of Representatives, as well as patient advocates, labor unions representing working Americans, and business groups. Repealing the Cadillac Tax is one of the most bipartisan health insurance issues facing Congress, and it's one of Congressman Courtney's chief policy priorities.

Learn more about how repealing the Cadillac Tax will help keep health care costs down for American Families

In a 2019 study, the Kaiser Family Foundation took a closer look at just how many employer health care plans might meet the definition of "high cost" over time if the Cadillac Tax was to be implemented, finding that "a growing number of employers will be subject to the tax unless they make changes to their health programs."

In fact, the Kaiser Family Foundation's research estimates that if the tax were to take effect in 2022, 31% of employers would be affected by the tax. That number would rise to 46% by 2030 unless firms drastically reduced costs. Excluding workers FSA contributoins, the Kaiser study estimates that 21% of firms will be subject to the tax in 2022, increasing to 37% in 2030.

Click here to read more from the Kaiser Family Foundation's report, How Many Employers Could Be Affected by the High-Cost Plan Tax

Analysis published in April, 2018 by Health Affairs noted that educators would be among those hardest hit by implementation of the Cadillac Tax.

Click here to read more about Health Affairs' analysis in their research article, Affordable Care Act's Cadillac Tax Could Affect One-Fourth Of Workers With Employer Health Coverage By 2025

Employer-sponsored health benefits whose value exceeds legally specified thresholds will be subject to a 40 percent excise tax, starting in 2022. The so-called Cadillac tax will be levied on insurance companies, but the burden will likely fall on workers. The tax will effectively limit the tax preference for employer-sponsored health insurance.

Read their briefing here.

See why patient, family, labor, and business advocates have all endorsed Congressman Courtney's bill to repeal the Cadillac Tax:

The American Federation of Teachers (AFT)

"The AFT has always opposed the 40 percent excise tax on high-quality healthcare plans [...] which will negatively impact families that have worked for, and earned, strong healthcare coverage." [...] "I want to thank Rep. Joe Courtney, who introduced H.R. 748, for his relentless efforts and commitment to repealing this counterproductive tax."

"H.R. 748 is an important opportunity for Congress to support high-quality health care and the employers that provide it. In recent years, deductibles in ESI plans have risen considerably while costs have continued to grow. The so-called "Cadillac Tax" creates the wrong incentive to employers around the nation. What we need now is higher value insurance, not lower value coverage."

First Focus Campaign for Children

"We strongly support H.R. 748 and its repeal of the "Cadillac Tax" because the excise tax worsens and compounds an enormous problem already inherent in the affordability of family coverage, as employers offer more generous coverage to individual workers than to families, including children."

International Association of Fire Fighters

"Voting yes on HR 748 would repeal the 40 percent tax on employer-provided health insurance and protect the healthcare that so many public safety workers have fought to get and protect."

Support from 665 Nonprofits, Businesses, and Patient Advocates

"While this tax was intended to only hit Americans with "gold-plated" plans, the reality is that very modest plans covering low- and moderate-income working families are projected to trigger the tax. The tax will disproportionately tax the health plans of women, seniors, working middle class families, the sick, and the disabled. Small businesses that already struggle to offer health care coverage will also be heavily penalized. This tax has real and harmful consequences – Americans cannot afford to pay more for their health care."

The American Federation of State, County and Municipal Employees (AFSCME)

"AFSCME strongly supports H.R. 748 because the 40% tax is already forcing insurers and employers to lower health benefits and shift medical costs onto workers and retirees."

The International Brotherhood of Teamsters

"The Teamsters have long opposed proposals that tax worker health benefits. Attempts to tax employer provided health care benefits through the 40 percent excise tax on high quality health care plans reduce the health benefits that hard working Americans receive and increase

"NRF appreciates Congress' past two successful efforts to delay the 'Cadillac Tax.' We urge its full repeal, however, because this tax forces the reduction of benefits well in advance of its effective date. Employers generally craft benefit plans two or more years in advance of the actual plan year. Benefits are being reduced now (increasing employee cost-sharing) to avoid the unfair tax on 'excess' benefits. We strongly urge your support for H.R. 748, bipartisan legislation to repeal the 'Cadillac Tax.'"

International Association of Machinists and Aerospace Workers

"In a time where so many Americans are feeling the pinch of rising healthcare costs, the so-called "Cadillac Tax", as it is commonly known, is a gut punch directed squarely at the middle class and working families."

Laborers' International Union of North America (LIUNA)

"Despite the tax's implementation being several years away, every union and business that offers employer-sponsored insurance (ESI) is already having to make adjustments given that healthcare costs are managed and negotiated several years in advance."

Society for Human Resource Managment (SHRM)

"The Cadillac Tax must be dealt with well in advance of its proposed implementation date, otherwise employees could see further changes in their benefit options."

"NTU has noted before that the Affordable Care Act's excise tax on high-cost employer-sponsored insurance (ESI), popularly known as the "Cadillac tax," is a poor solution to a real policy dilemma - addressing the employer-sponsored health insurance tax exclusion that has distorted markets. Even though the intent of the tax was to reduce health care costs and boost the economy, the Joint Committee on Taxation (JCT) and the Congressional Budget Office (CBO) have estimated that the Cadillac tax will depress wages."

International Union of Operating Engineers

"The International Union of Operating Engineers supports H.R. 748 and respectfully requests that you repeal the tax on high-cost health insurance premiums as quickly as possible. We believe that permanent repeal of the 40-percent tax should be a top priority for this 116th Congress, and we look forward to working with you to enact it into law.

The Partnership for Employer-Sponsored Coverage

"The 40 percent excise tax, also known as the Cadillac tax, would force employers to cut or limit employee benefits. The tax is a blunt instrument that proponents envision will address the demand side of rising health costs. While dubbed the Cadillac tax because the provision was targeting "high cost" employer-sponsored health coverage, it would impact the vast majority of employee benefits plans."

The Associated General Contractors of America

"The 40 percent excise tax, also known as the "Cadillac tax," would force contractors to cut or limit employee benefits for millions of employees. Though dubbed the Cadillac tax because the provision was targeting "high cost" employer-sponsored health coverage, it is causing an adverse effect on the affordability and quality of health coverage available to construction employees and their families even before it has taken effect."

The Council of Insurance Agents & Brokers

"The tax was intended to impact Americans with "gold-plated" plans, but the reality is that very modest plans covering low- and moderate-income working families will trigger the tax. More than 181 million Americans – including retirees, low- and moderate-income families, public-sector employees, small business owners, nonprofit workers and the self employed – currently depend on employer-provided health coverage. Employer provided coverage covers more Americans than Medicare and Medicaid combined. This tax has real and harmful consequences – Americans cannot afford to pay more for their health care."

National Association of Manufacturers

"While this tax was initially intended to impact high-cost employer-sponsored health care plans, it is expected to burden a broad cross-section of small and large employers across the country and to discourage employer innovations that are improving benefits for manufacturing workers. Manufacturers have been forced to begin plan preparations even though the tax is scheduled to go into effect in 2022. Fully repealing the Cadillac tax, health insurance tax and medical device tax remain top health care priorities for manufacturers."

"With more than half of Americans covered under employer-sponsored healthcare, the so-called "Cadillac Tax" could affect the healthcare costs of more than 181 million Americans across the country. By allowing this excise tax to go into effect, hardworking middle-class families with employer-sponsored healthcare plans could face reduced benefits and increased out-of-pocket costs as employers push to restructure and renegotiate workers' hard-earned healthcare benefits."