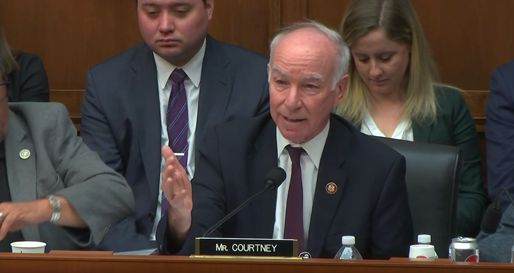

Rep. Courtney Questions Secretary of Education Betsy DeVos on Efforts to Undermine Protections for Student Borrowers

WASHINGTON, DC – Today, at the House Education and Labor Committee hearing, "Examining the Policies of the U.S. Department of Education," Congressman Joe Courtney (CT-02) questioned United States Secretary of Education Betsy DeVos on the Department's recent actions which undermine protections for student loan borrowers. In December 2018, Secretary DeVos and the Department of Education issued a memorandum barring student loan servicers from releasing important information to state law enforcement officials, hindering their ability, as well as the ability of federal agencies like the Consumer Financial Protection Bureau (CFPB), to maintain proper oversight of loan servicers who might be engaged in unscrupulous practices.

Click here to watch Rep. Courtney's remarks

During his remarks, Courtney noted the track record of success that state law enforcement has had in shutting down deceptive student loan practices, and in finding recourse for students who were mistreated by loan servicers. Courtney emphasized the fact that Secretary DeVos's move to weaken protections for student borrowers came just weeks before a report from the federal Office of Inspector General (OIG) that found 61% of loan servicers were non-compliant with Department standards.

"This [Department of Education] memo has had the effect of undermining all state investigations into shady practices, as well as federal investigations by the CFPB into loan servicers," said Congressman Courtney. "Brazenly, the Department did not even publicly notice this memo, and it was only obtained because someone at the Department leaked it. So, I want to ask, given the fact that state law enforcement has had a spectacular record of success in terms of getting restitution for student borrowers who, again, had their funds misappropriated, shutting down deceptive practices – as the New York AG, Minnesota AG, Illinois AG, Connecticut AG, they've all been doing this work collaboratively with the federal government – what is the rationale for the Department to shut off that flow of information regarding student loan servicers, which has been standard operating procedure for decades?

"This is a decision you made – to shut off this information to people who are law enforcement. They're investigating things like fraud. So please explain the decision in that memo."