CT Mirror: CT CPA’s warn of dire impact of new federal tax plan

December 7, 2017

By Ana Radelat

Washington – Connecticut's accountants are frustrated that they can give clients only limited advice about a massive federal tax overhaul underway in Congress, and some predict there will be more losers than winners among individual taxpayers in the state.

"They are likely to see their federal taxes increase next year, and they should be aware of that," said Bonnie Stewart, executive director at the Connecticut Society of CPAs.

Stewart said the state's certified public accountants are being deluged by clients, both business owners and individuals, asking how they would fare under the new tax bill.

"The calls are coming in to accounting offices across the state," she said.

But without a final bill, there is limited information the state's accounting professionals can give clients.

"On the individual side, there's not great news for Connecticut residents," Stewart said, but the tax overhaul may be "more positive on the business side."

As far as individuals, Stewart said she cautions against buying a new home or making another large financial decision before the House and Senate negotiate a final bill that reconciles differences in the separate bills each chamber has approved.

Still, that final bill is likely to hurt many individual taxpayers in Connecticut, and other states with high state and property taxes, like California, Maryland and New York, whose taxpayers have benefited from deducting the cost of those levies on their federal tax forms.

The reason the state's CPA's are taking a pessimistic tone with many individual taxpayer clients is the House and Senate tax bill's elimination of the deductibility of state and local income tax and it's $10,000 cap on the deductibility of property taxes.

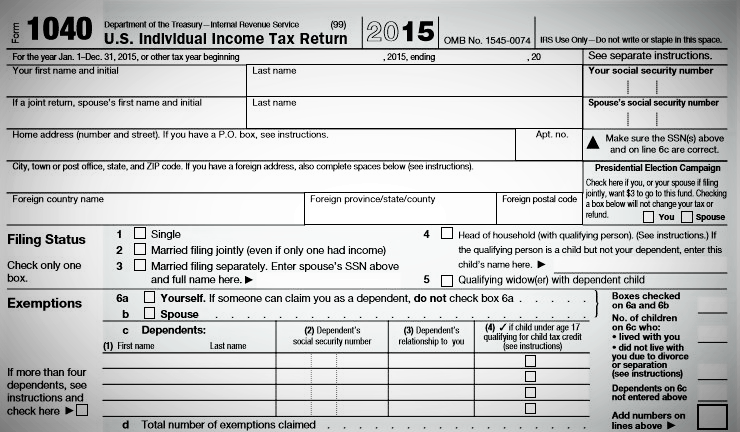

Andrew Lattimer, a CPA at BlumShapiro, said he's telling Connecticut clients to pay property taxes due early next year before Dec. 31, so they can deduct them under current IRS rules. The new tax bill would not take effect until the 2018 tax year.

Stewart recommends Connecticut residents pay any personal property taxes on newly purchased cars, boats, motorcycles and trailers before the year's end.

...